As of April 1, 2023, no new Alojamento Local licenses will be granted in Portugal, read all about it by clicking the image above.

As all of you know I am a huge fan of AirBnB. We started using AirBnB as travelers in 2010, stayed at over 100 Airbnb rentals and hosted for a while (we were super hosts). Airbnb allowed Antonio and me to travel the world and to find our future home in Portugal (we actually stayed for months at a time at Airbnb Lisbon properties in different neighborhoods to see which would fit us best). We are not currently running an AirBnB here. We did that for a ton of years and just needed a break, but since some of you may be interested in running and registering an Alojamento Local (aka – an AirBnB , Homeaway, etc), I figured it would be good to give you a starting point.

How to Start an Airbnb in Lisbon.

As I mentioned, this is for those of you who have already done some research. You’ve already asked if Airbnb is legal (which it is), and you’re ready for more. There are 10 steps I have outlined you need to plan for when opening up and Alojamento Local business in Portugal. Alojamento Local (AL) literally means “local accommodation”, but it is really a short-term rental. A business of this sort can be a regular BnB, a CrowdSurfing apartment, an AirBnB rental, an apartment that rents rooms to students…you get the gist.

Wondering how many Alojamento Local AirBnB like places there are in Lisbon? As of 2019, it’s 18,000.

Requirements for Alojamento Local (AKA Airbnb) in Lisbon, Portugal

I’m not going into the real beginner part of this adventure…your business plan, market analysis, etc. I am going to assume that you are already living in Portugal, have your NIF, et al…This post is for those who are really ready to get their new business started.

1. Check if The Neighborhood is Zoned for Alojamento Local

Alojamento Local is a tricky thing here in Lisbon. Foreigners who scoop up homes to set up as short term rentals are often blamed for the high rent costs and displacement of the city. I am not going to get into the particulars of that (yes, we are partially responsible but not the only factor here – as someone from NYC that has seen and felt gentrification in full force, I get it). The reason I mention this is because laws for setting up an Airbnb in Lisbon are getting stricter by the day.

For example, a 2018 change made it so that your local council and condo boards have a say in Alojamento Local registrations, so your board could block you from starting your business. This means you really need to check with your board, neighbors, and freguesia.

There are also forbidden areas. That means that certain neighborhoods are not granting any more licenses for new alojamento local businesses in order to preserve the cultural integrity of the city.

Here in Lisbon as of 2019, you will NOT be able to request a license in the following neighborhoods:

- Bairro Alto

- Madragoa

- Castelo

- Alfama

- Mouraria

Before you go and buy a house with dreams of turning it into an AirBnb property in Lisbon, make sure to go to the Câmara Municipal (City Hall) to ask if the area where you would like to set up your AL allows for new licenses.

2. Set Yourself Up as an Atividade Independente at the Tax Authority.

Assuming that you already got your Portuguese Tax ID Number (aka – NIF), you need to go to the Financas website and set yourself up as a someone who works in atividade independente.

What does that mean? It’s basically saying that you are an independent contractor, that you are your own boss. The one thing you need to worry about is that you set yourself up for your perfect code. There are codes for teachers, sitters, and – of course – those who run an alojamento local.

What is the atividade independente code for Alojamento Local?

Easy, it’s “CAE CAE 55201” (that is the code for Alojamento Local para Turistas) or “CAE 55204” (the code for Other types of Short-term stays).

Where do you set yourself up as a practician of atividade independente?

You can do this at the Finanças Office, or at a Loja do Cidadao. There are plenty of offices throughout the city.

Any other advice on setting yourself up as atividade independente?

Heck Yeah. I would advise that you do this with a Portuguese tax lawyer so you do it right the first time. For me, it is just not worth it to deal with headaches later.

3. Understand Yout Tax Liabilities.

Speaking of taxes and lawyers, you need to make sure that you understand how this atividade independentestatus will affect your Portuguese taxes (and those in your home country).

The income that comes in through an AL property is considered Category B. As such they are subject to the regime simplificado (simplified tax regime).

What Does Regime Simplificado Mean?

It means you don’t need a dedicated licensed accountant if…

a) You don’t make €200,000 in two consecutive years

b) You don’t make €250,000 in one year

There is more to this that will be discussed in the IRS section. In both of the above cases, you will need to use a certified accountant. As I always advise, make sure you speak to your Tax lawyer on this and see if you need to be set up with a certified accountant. Laws change fast and this was the most updated info I could find.

Perks of Being in a Regime Simplificado

I could find only one (besides not having to pay for a dedicated accountant). You don’t have to pay the VAT on items purchased for your property (say furniture, paper towels, the wine you leave for guests) until you reach 10K euros. Once you reach this number, you will have to both charge VAT and pay it.

What Do I Need to Know About Taxes as someone who runs an AL in Lisbon?

With the simplified regime, 35% of income is taxed as a Personal Income Tax.

You as a Tax Payer in Portugal, must submit Annex B in your IRS tax return and fill in field 417 (table 4A).

If you have registered as atividade independente and don’t work for others and / or are not a pensioner, 17.5% of income earned in the first year is taxed and 26.5% in the second year is subject to income tax.

Taxpayers with Category B income up to 27,360 expenses do not need to report expenses.

Those who run Alojamento Local as a business who make more than the 27,360 mentioned above must report expenses so that only 35% of the income gained from AL is taxed.

If you want to know the amount of expenses to be claimed/justified, you can use the following formula:

15% of gross income – 4104 = amount of expenses to be claimed/justified.

The resulting number will be the amount you enter on your e-invoice (the online tax system), answering yes for the question “in the context of professional activity?”.

What is considered an expense for your Alojamento Local?

- 4% of the property value of the property

- Insurance

- Electricity

- Water

- Gas

- Cleaning

- Commissions paid to platforms such as Airbnb, Booking, or HomeAway.

If the property is only partially used as an Alojamento Local, only 25% of the expenses will be considered as deductions.

Are there other ways to file your Alojamento Local income?

You may also be able to bundle your AL income as category F. If you are eligible, your Airbnb income will be taxed in full at the rate of 28%, after expenses are deducted. If this interesting to you, you can opt-in on table 15 of Annex B of model 3 of your tax return statement.

***The reserve values in case of withdrawal are also income and the tax authorities 10%. You need to enter these in field 414 of table b of model 3 of the IRS statement.

Do I need to contribute to Social Security?

As of January 2019, income earned from Alojamento Local doesn’t require social security contributions. If you only make income from Alojamento Local, there is no action needed on your part. This is good and bad. That means that for now, you can keep that money and put it to good use. However, this could be a bad thing since you won’t be contributing to your pension. This is something you should consider and plan out for your future.

However, if you are set up with another atividade independente, you are obligated to file a statement quarterly, where you identify Alojamento Local income so that it is exempt from Social Security contributions.

Those who make income from Alojamento Local, are exempt from VAT up to 10,000 per year.

Once you make more than 10,000 per year, you must disclose to the tax authority in January of the following year AND begin to charge VAT starting February. VAT declarations are quarterly.

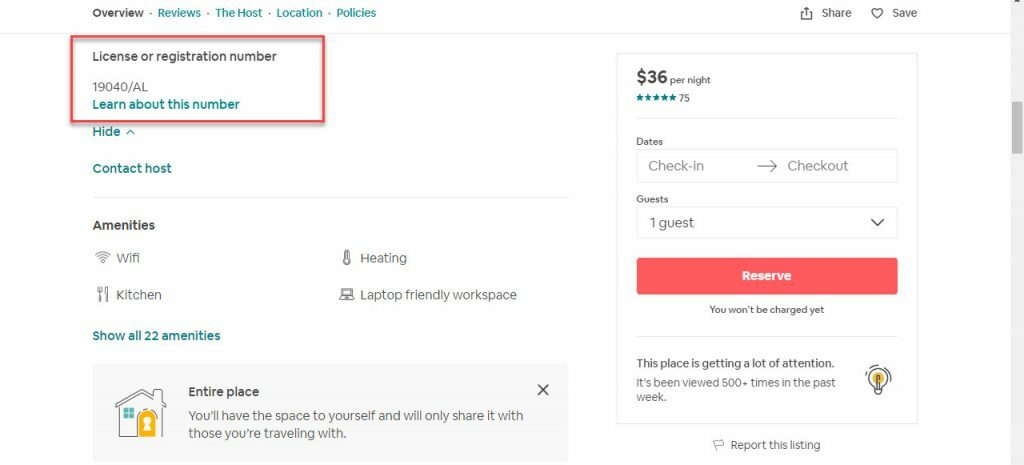

4. Establishing an Alojamento Local (Airbnb)

In order to operate an Alojamento Local you MUST register the Airbnb at the Entrepreneur’s Desk (Balcão do Empreendedor).

Once you register there, you will receive a registration number which serves as a valid title allowing you to operate and advertise the property.

When you choose to use platforms that help you in booking stays, or advertising, they must have the capability to include the registration number on your listing.

NOTE: For a list of Airbnb type properties that are registered you can check the National Register of Local Accommodation Establishments (RNAL), and check their location on SIGTUR.

5. Pre-requisites for Approval of Your Alojamento Local

Once registered, the Camara Municipal (municipal chamber of your city, in this case, Lisbon) will inspect to make sure the property is ok for use as an Airbnb (alojamento local) and that you are following all safety requirements. Below is a list of all the items your Airbnb (alojamento local) must provide its guests on every visit:

- Fire extinguisher

- Fire blanket

- First aid kit

- Visible explanation of the 112 emergency number

- Complaint book (it’s a red book that says livro de reclamações on the cover)

- Information book

The complaint book must be available in book form as well as digital format.

The information book must contain the following:

- Rules for the collection and separation of waste.

- Instructions on how to operate household appliances.

- Rules on what needs to be done to not disturb the neighborhood and immediate neighbors.

- Any condo information and rules on how the private space is to be used as well as how the common areas are to be used.

- The telephone and email address of the person who operates the establishment or their agent.

The information book must be available in four languages in total, two of those must be Portuguese & English.

If your Airbnb can fit more than 10 guests, you will be held to stricter fire safety rules.

PRO TIP: Join ALEP (the Alojamento Local Association in Portugal). They offer benefits through partners, financial and legal help, and they act as representatives to those who work in Alojamento Local.

6. Invoicing

Those who run an Alojamento Local property must generate invoices online through the AT portal. They may also do so through a certified program, but the invoices must still be reported to the AT.

7. Report Foreigners to the SEF

When foreign guests enter and exit your Alojamento Local, you must report it to the SEF here. To do this, you must register in the portal. Do this sooner, rather than later.

8. Sign Up for Compulsory Liability Insurance

It is mandatory to have multirisk insurance for civil responsibility that covers the risks of fire, patrimony and harm or damages caused to guests and third parties due to your alojamento local activities.

If your insurance is not valid or up-to-date your Airbnb license can be revoked. If your Airbnb was in place before October 2018, you have 2 years from then to comply with these requirements.

9. Increased Condo Fees

It’s not as bad as it seems. If your alojamento local property is in a “horizontal property” like a condo, said condo can increase your condo fees. Why? Because of the wear and tear on common areas. How is this calculated? It’s very simple. The condo board can only charge you max a 30% increase on what you pay in condo fees annually. For example:

- You pay €20 monthly towards condo fees.

- 30% of that is €6

- .You pay €26 monthly at most.

Your condo association may only charge you 15%. It’s up to them how high they choose to go up to 30%

Make sure to vet your guests. If there are habitual disruptions to the residents in the building or damages to the building that are caused by your guests or your AL, the condo board can take a vote to close your listing. If they get 51% of the vote, your Airbnb can be closed. The procedure on their end is to let the Mayor and City Council know about the issues and the vote, and then your registration can be shut down for a year.

10. Charge Occupancy Tax

In Lisbon, it is mandatory to charge a nightly occupancy tax of €2 PER PERSON. Kids younger than 13 do not have to pay this tax. The good news is that they only have to pay that for 7 nights.

It is mandatory that you register the payment of this tax on the platforms created for this purpose by the municipality of Lisbon.

I hope that you find this article on how to plan and set up your Lisbon short term stay business helpful. If you have more questions, ask. We look forward to hearing from you.

11. Things That May Affect your AirBnB – Alojamento Local Business in Lisbon

This is an update as of May 14. Due to the COVID-19 pandemic, many Airbnbs and Alojamento Local businesses are struggling. If this is you, the government recently made changes that allow you to change your AL to a regular long-term rental property without a tax penalty. However, there is a caveat. If you go through this change, it must remain as a regular long-term rental property for a period of 5 years. Before this law passed, you’d pay taxes as if there had been a sale. Now you won’t. But you should read more about tenant rights before choosing to make this move. There are many tenant protections in Portugal that could make this option less than palatable for you.

Do You Run An Alojamento Local in Lisbon?

I’d love to hear things from your end. What do you love about it and what are your challenges? Is there anything I missed that you think is important to all? Let us know.

April 2022 Update

A new law has passed that does not allow Alojamento Local properties to be in residential buildings. The law is retroactive and applies to previously approved short term rentals already existing in residential buildings.

Very good article. You outlined the overly-complex process so well that you make it sound easy. I’m in the process of opening my first (legal) AirBnB in Lisbon and I have loads of details to deal with that I would need some help. I was thinking about getting a virtual assistant but that can be tedious when there is a lot of boring paperwork and the requirements are endless and always new yet equally boring as you go through all of the bureaucracy. Then I thought about hiring a company that specializes in setting up AL. Do you know of companies that perform that service? I’m also not keen on all of these taxes and fees when you’re just getting started on a new business venture. Is there any way to offload some of the taxes to later years? For example, I’m renovating my apt and I was thinking about making it more energy efficient and I was told I can get a massive tax break on tax I’ve already paid if the inspector agrees with the upgrade. One thing I do remember reading in you article was how one is supposed to deal with one’s new neighbors? They have to give permission (at least 40% of the building I think). I would like to hire another person to do that chore as well.

Michael,

I may know someone. Let me reach out and find out if she can help.

Blanca

Can I give her your email? Her name is Rossana and she can help you in these aspects.

Thank you Blanca! I really enjoyed reading your post, it is enriched with useful content and advises.

Hello Michael, we help people and businesses to settle down in Portugal, and we also have a smart-living housing solution for global citizens. I believe we can help you with your AL project, I will send you a PM message.