I am shocked when I keep seeing articles touting Portugal (and Lisbon) as one of the best places for expats and digital nomads to move to. Sure, it is still incredibly safe and the weather is still wonderful; but prices are not what they used to be. If you are moving to Portugal and you’re affluent in the states, you won’t have a problem, but those people who move here because “Portugal is cheap” are in for a big surprise. The prices for almost everything are skyrocketing. I see a dim future for those who have purchased property in the past 5 years. Today, I will lay out the reasons why I think that Portugal’s housing market bubble will soon burst, and why if you are in the market to purchase property, you may want to wait…unless you don’t care about losing a significant amount of money on a bad investment.

UPDATE - March 31, 2023

The Portuguese government has passed major Alojamento Local reform. Alojamento Local deals with all the rules for hotels and vacation rentals. The biggest change that is happening is that the Portuguese government will not be issuing any new Alojamento Local Licenses until 2030. Any current licenses will stay, but will expire in 2030. This and many more changes, tell me that foreigners and locals will be less willing to invest in real estate in Portugal since the investments will be riskier. Read all about the suspension of new Alojamento local licenses by clicking here.

UPDATE - December 15, 2022

Moody’s has predicted that house prices in Portugal may fall up to 3% in 2023.

The entire world is going to face financial challenges in 2023. Our government will have to deal with inflation, geopolitical changes, and financial market instability, all things that will affect us. This, combined with the predicted drop in house prices, increase in interest rates, and new laws to curb alojamento local properties points to a difficult year ahead for the housing market in Lisbon.

This property dropped by 160,000 euros from September to October 2022.

This property dropped by 70,000 euros from October to November 2022.

This property dropped by 55,000 euros from November to December 2022.

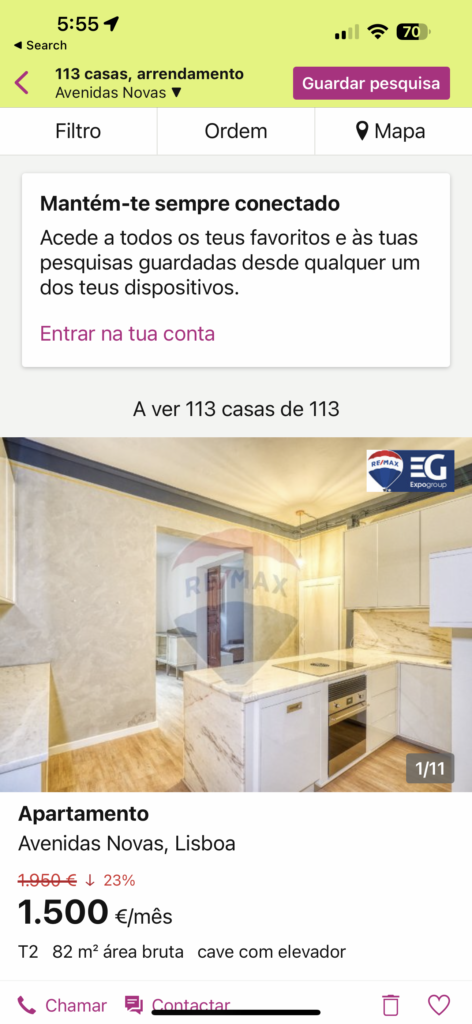

This rental property dropped by 55,000 euros from March to April 2023.

Portugal has the hottest and probably the quickest growing real estate market in Europe. Unfortunately, it does not match up to the GDP or salaries of the local population. The prices of real estate in Portugal have been driven by Golden Visas, vacation rental investments, and the relative affordability the country has to offer to foreigners. However, the pandemic, high inflation, and rising costs are creating an environment that makes the burst of the real estate bubble more likely to happen soon.

In this article, I will look at Lisbon (which has the most inflated market) since that is the city where most people want to move to, and Portugal, and give you some financial stats so you can make an educated choice before buying or renting property in Portugal (I’m not diving into why there is a rental bubble in Lisbon, but maybe I’ll dig into that in another article). I’d love to hear your comments and predictions, so leave a comment when you’re done reading.

Average Home Price in Lisbon By Year

2016

2018

2020

2022

1,968€/m2

2,438€/m2

4,711€/m2

5,130€/m2

Average Home Price in Portugal By Year

2016

2018

2020

2022

866€/m2

996€/m2

2060€/m2

2,360€/m2

The Potential End of The Golden Visa

On Nov 2, 2022; Portugal’s Prime Minister, António Costa, said that there are plans in place to end the “Golden Visa” program. A few days later, he announced that a special group had been put together between to evaluate the Golden Visa regime. The program allows wealthy foreigners to obtain residency by either investments into Portuguese companies or buying property. This scheme has been the source of controversy since the majority of Golden Visas (92%) have been granted via Real Estate investments, which has increased housing prices in Portugal. There is also talk of money laundering via this kind of investment. If (when) the Golden Visa program is scrapped, there will be a lot less interest in the market, which since its inception in 2012 has brought in almost 7 billion euros.

Portugal's Artificially Scarce Real Estate Market

You will hear people (aka realtors) say that it is impossible to find a home or apartment in Portugal. Sure, it’s hard to find a place to buy that is not ridiculous priced. However, there are plenty of properties, that sit empty. There is actually plenty of supply and there will be more in the future. In fact, in Portugal, there are almost 600 homes per 1,000 people who live in Portugal.

If there are so many homes in Portugal, why is there low supply of homes on the market? Let’s crunch some numbers.

How many properties in Portugal are used for Alojamento Local (holiday lets)?

106,000+ properties in Portugal are used for alojamento local – Aka Airbnb. In Lisbon ALONE there were ore than 26,046 local accommodations.

How Much Tax Do Alojamento Local Owner Pay?

35% of income is taxed as a Personal Income Tax. If you have registered as atividade independente and don’t work for others and / or are not a pensioner, 17.5% of income earned in the first year is taxed and 26.5% in the second year is subject to income tax.

What Changes Are Expected To Be Made to Alojamento Local Businesses?

Owners of vacation properties in Portugal may get a pretty bad surprise soon. According to ECO, 2023 will be a year of more restrictions for Alojamento Local type properties. The Socialist Party has proposed further limitations to new AirBnB properties. On the table is also a 100% increase of taxes paid by AirBnB owners who have their properties in “areas of urban pressure.

How Many Abandoned Houses Are There in Portugal?

There are 730,000 empty and abandoned properties.

How Many Empty Houses Are There In The Lisbon Area?

Within the 18 municipalities in the Greater Lisbon area, there are 160,000 empty homes.

What rate are landlords charged for rental income taxes?

Landlords in Portugal pay 28% in taxes for rental income.

What percentage of tenants in Portugal late on their rent?

1/4 of tenants are late in rent somewhere between 3-6 months.

What percentage of Mortgages in Portugal are set up with a variable rate?

93% of all mortgages are set up with variable interest rates.

What is the rate of inflation in Portugal?

The rate of inflation is currently at 9.1%.

What are the current interest rates in Portugal?

Interest rates are rising quickly. The average interest rate on new home loans in Portugal is over 2% (the highest since May 2016). In new consumer loans, the average interest rate increased to 7.93% (7.88% in July).

Are wages increasing in Portugal to match inflation?

Not really. While wages in Portugal increased by 4.20% when comparing Jan 2022 to Jan 2021, this does not keep up with the rise of inflation and interest rates.

Is it getting harder to get a home loan in Portugal?

Yes. The ECB’S Euro Area Bank Lending Survey found that in relation to home loans, banks will be tightening up credit standards which will make it harder to get a home loan. They also expect a decrease in the demand for home loans, which again signals to the Portuguese housing market bubble pop.

Why do I think these point towards a crash of the housing market in Portugal? We already discussed why there is an inflated scarcity in real estate. Increasing interest rates combined with variable rate mortgages will result in an increased number of mortgage defaults. This will bring more homes into the real estate market and prices will deflate.