If you have been reading my blog you know that I’ve flown to 54 countries. Most of the time, I’ve flown on first or business class. I am not rich and it is not so hard for you to do this too. I flew from Tokyo to Newark with Business First, it was a 16 hour flight. This would have cost me an arm and a leg ($7500), instead I learned to earn credit card miles and fly for free.

Now you can argue that you don’t want to fly business because of the cost but if you plan your awards travel properly it will be almost free. All it takes is some credit card hacking, discipline and know-how.

Personally, I don’t travel on a weekly basis. I’m more of a slow traveler. I pick a location and usually stay there at least a month (I’ll break this rule sometimes for a 14 day stay in a location I’m not sure about such as Pula, Croatia). The point here is that I am not racking up frequent flier miles like a traveling salesperson would, but I still get free flights and upgraded travel experiences by collecting travel points. You can do this too. In this post I will introduce you to the basics of travel hacking so that you can earn money for flights. I’ll teach you how to find the latest credit cards making offers.

How to Earn Credit Card Miles and Fly For Free

Before you even think of scheduling a vacation (holiday), do the search for your flight. If you can be flexible, you will be at an advantage. Check out secondary airports in main cities, but just be careful – sometimes the taxi ride to town can be quite expensive, so while you save on the flight, you may lose money on local transport.

Tips to Find The Cheapest Flights Possible

- For International Travel: Check currency exchange rates. If the country you are traveling to has a cheaper currency, their website may to. In this case, for example, if you’re flying to Portugal, don’t go to their US site (flytap.com), go to their Portuguese site (flytap.pt) because at times a flight can be cheaper in a foreign currency. In this case, check the fine print on your travel credit card to see if they charge foreign transaction fees. This is especially great currently because of the Brexit. The pound sterling is as of this article £1.22 to $1 USD. So UK is cheap! When you are on the website for any airlines or hotel change your currency between USD, Euro and Pound and see if you can get a better deal. Just Google the exchange rate or check your credit card companies’ rate.

- Check the Airport Website: Then make a list of all the airlines that fly to that airport. Some lesser known airlines will charge you less for a flight, but don’t have deals with aggregator sites like Expedia.com. Airlines to think about would be:

- Europe Cheap Airlines

- 1 Norwegian

- easyJet

- Eurowings

- NIKI

- Ryanair

- Vueling Airlines

- Wizz Air

- airBaltic

- Pegasus Airlines

- Monarch Airlines

- North America Cheap Airlines

- Virgin America

- WestJet

- Southwest Airlines

- Air Canada Rouge

- Frontier Airlines

- Spirit Airlines

- Interjet

- Volaris

- Sun Country Airlines

- VivaAerobus

- South American Cheap Airlines

- Azul Airlines

- Easyfly

- Gol

- VivaColombia

- Asia Cheap Airlines

- Indigo

- SpiceJet

- GoAir

- Mihin Lanka

- airblue

- Middle East Cheap Airlines

- flyDubai

- Air Arabia

- Jazeera Airways

- Up

- flynas

- Europe Cheap Airlines

- Australia/Pacific Cheap Airlines

- Jetstar Airways

- AirAsiaX

- Scoot

- Tigerair Australia

- Cebu Pacific

- Africa Cheap Airlines

- Kulula

- Mango

- Fastjet

- Jambojet

- fly540

- Australia/Pacific Cheap Airlines

Collect and Earn Credit Card Miles and Fly For Free

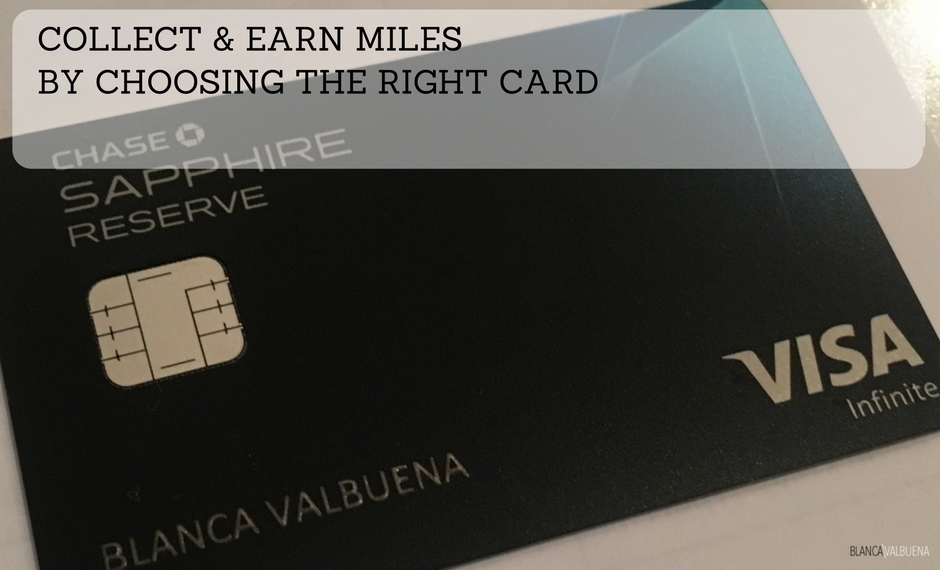

Pick an airline that frequently flies in and out of your city. Then research the credit cards that offer miles for that airline. I chose United since it flies out of Newark and I picked up the Chase Sapphire Reserve. As soon as I signed up it gave me $300 for the year in travel credit (score!). There were other travel benefits including 3x points on dining and travel, free airport lounge access, and Global Entry (double score!).

Now that you have the card, you need to use only the card you chose for your airline, and then you need to make sure it is paid off every single month. You are to use this not as a credit card, but as a charge card. Otherwise it won’t be a value. These cards need to be use methodically so you can quickly accrue points. You want to be loyal to that card and that airline, sometimes with enough use you can get preferred status which gets you even more perks, like first-class upgrades. I get bumped up usually ever 5 trips if I am doing a short economy leg of a trip.

How to Get Upgrades with Your Travel Credit Cards

Let’s be frank here. 99.99% of the population can’t afford a first-class plane ticket. What usually happens is that a day or two before your flight is due to depart, your airline will award loyal customers with their unsold first-class ticket inventory. The most loyal customers usually get first dibs. Check your email, they usually will offer you on under-booked flights an upgrade option for a few hundred bucks to jump to Business or First Class.

How to Score Your First Free Flight

I’m going to break a few hearts here (and it’s not because of my good looks). It really helps if you have great credit and little to no debt. If this is you, now you need to do a little research to see which airline mile credit cards are offering bonuses for sign ups. Often times this credit is enough to get you your first flight free.

What you don’t want to do is get that credit card, get the miles and close the credit card. This will hurt your credit score. You want to make sure that you keep (and use) this card responsibly for a while. Again, you’ll be rewarded for your loyalty. Most of the larger cards have a $450+ annual fee, so you need to get the most value out of the card.

A List of Non-Credit Card Offer Rewards Programs

If you don’t have good credit, you can still help yourself a bit. There are plenty of travel rewards programs from airlines and hotels that you can take advantage of. Here’s a list to get you started:

- Air Canada Aeroplan

American Airlines AAdvantage

Delta SkyMiles

Frontier Airlines EarlyReturns

JetBlue TrueBlue

Southwest Airlines Rapid Rewards

United Airlines MileagePlus

U.S. Airways Dividend Miles - Hotels Plans

Hilton HHonors

Hyatt Gold Passport

InterContinental (Holiday Inn) Priority Club Rewards

Marriott Rewards

Radisson Gold Rewards

Starwood Preferred Guest

Wyndham By Request

These rewards offer points for travel, but also for doing things like taking part in surveys or purchasing items through an affiliate link.

Buying Upgrades

Sometimes you won’t travel enough to earn a full ticket. That’s totally ok. Airlines will let you purchase the remainder of the upgrade. On top of this, there are points challenges. Call your airline, let them know you’re a frequent flyer and that you want to take a points challenge. It will be cheaper than purchasing the first class flight outright, but cost more than if you earned them. If I am running out of points I usually will book part of the flight with points and rest on my credit card (hence getting points)

Get the most out of your rewards

You can only collect points so fast, so you’ll need to travel a bit to accumulate much of a balance. Credit card bonuses are obviously the fastest way to accelerate this. But the real art of travel hacking is not in collecting points, but in redeeming them.

Most of the time, a single airline mile is worth somewhere between $0.01 and $0.02. It all depends on how you spend it.

You might, for example, redeem 50,000 miles for a round-trip domestic ticket that costs $300. That’s a per-mile value of just six-tenths of a penny. Not good.

Let’s say, however, that you save up 200,000 miles and redeem them for a business-class international ticket that sells for $8,000 (crazy, I know). You’re getting $0.04 per mile. Obviously, rewards are only good if you can use them—so this won’t always apply. But this is also why it makes sense to focus your efforts (at least in the beginning) on one or two airlines, so you can obtain a critical mass of points more quickly.

One of the things I like to do is spend everything on my cards. This means not using cash for things like gas, groceries, Uber/taxis, car rentals, drugstores, etc. I almost never pay cash for anything. Just think of it; the average person spends say $2-$4k a month. If this is you, you can get 2 free international economy flights a year. Not bad right?

Admittedly, it can take a long time to hack your way to a completely free vacation or international first class flight. Cheaper economy flights can go as low as 15k Miles, while Business can start at around 75k Miles.

Credit card sign-up bonuses, however, will always be the absolute fastest way to score free travel.

For example, if you have excellent credit, are willing to signup for two or three new credit cards, and have a way to responsibly spend a few thousand dollars in the next three months, you could just as soon find yourself with $1,000 worth or more of credit card miles good for free travel. I recently signed up for the American Express Delta Sky Miles and got a 50,000 miles for only spending $1500 on the card. Not a bad deal.

Let’s be clear here—I’m not advocating going into debt or buying things you don’t already need—but if you time it right, many new travel hackers use these signup bonuses to get fast-track a free or heavily-subsidized trip.

Three travel sign-up bonuses to note include:

- Earn 50,000 bonus points (up to $625 in free travel when booked through Chase Ultimate Rewards) with the Chase Sapphire Preferred card if you spend $4,000 on purchases with 90 days.

- Earn 40,000 bonus miles (worth a $400 travel statement credit) with the Capital One Venture Card if you spend $3,000 on purchases within the first three months of account opening.

- Earn 20,000 bonus points (worth a $200 travel statement credit) with the Bank Ameria Card Travel Rewards® Credit Card if you spend $1,000 on purchases within the first three months.

Now you know how to Earn Credit Card Miles and fly for free (or at least cheap). If you have questions on any of this, just ask in the comments section.

These are smart tips. My sister and her husband travel a lot for work and end up flying free quite often.

You really can fly quite cheap. I’ve been churning for airline miles for a while and it’s awesome. I just make sure to always pay at the end of the month so there’s no balance 🙂

Thanks for all these great tips. We travel a lot and try to earn and use points as often as we can.

My wife is the points master!! These are great tips she is always getting us free flights with her points.

this really great advice and tips. i am passing them along to my daughter as i will not fly …but if i did i would absolutely use the tips you provided. thank you

This was a great tip, thanks for sharing it and letting us know the privilege we oughta have.

Same here. Points are where its at. I really like the Chase Sapphire. The rewards are totally worth it.

The points are so good. Some people like them for hotels, I’m more a flight gal. Although now that Airbnb works with Amex points and offers Gift cards…I may have to make some changes 😉

Oh no. There are always cruises. I was thinking of doing a cross Atlantic one.

I love using my card to get the points. I buy everything with my card.

I think she and I would get along 😉

Darn right. We all deserve to travel like humans. The worst is when you get somewhere and you’re in so much pain you miss the first 3 days of your trip.

Me too! I rarely use cash just because of that. Chase is also very good about protecting their clients. They’ve given me excellent customer service.

This is such a cool traveling tip! Thank you so much for sharing it

Glad you enjoyed. We should all be able to travel like humans…and it’s not as difficult once you get the hang of it 😉

i travel a lot and these are great tips. i just started getting points. i wish i would have started doing this earlier

Me too. I’ve been doing this for about 10 years. Wish I knew earlier.

This is a really great list of tips and tricks! I like to travel but am often hesitant in actually going anywhere because of all the costs.

I hear you. Flights can be so prohibitive in cost. Let me know how it goes with churning…I also recommend using home sharing services like Airbnb. They are so much cheaper than hotels and you get so much more. Happy travels.

I do not really do any flying to places but I have always wondered how this works for others.

I learned it the hard way when I closed my card once after I’ve collected points. This is such a handy guide, I’m prepping my next year up for a lot of travels!

Those tips are really helpful for me. I will try them all. Traveling for free should be awesome!

Who wouldn’t want to fly for free! That’s defintely going to give you more pocket money. I really appreciate these tips!

Thank you for this I need to start doing it. I’d love to fly for free or cheap!

Wow, never really knew the difference between what costs and what’s free in terms of choosing the right meal at business class trips. I haven’t really travelled a lot abroad but it sounds so tempting to earn rewards and points for free flights and exclusives.

Wow! I had no idea about some of the hacks you are mentioning! I have used the foreign currency trip and saved some money thanks to it! Have to learn so much more about credit cards, though!

A non-traveller having free flights? Amazing, you might have just influenced me to take a trip here and there and earn some.

Sadly, i don’t travel much. My friends do and it’s true, these frequent flyer programs surely cuts down the cost. Nice ideas here.

I am in Europe and 90% of the time I fly with Wizz Air or Easyjet and I am not making use of my air miles which I intend to start earning properly in 2017. These are some awesome tips, thanks for sharing

I bet there is churning for cruises…I’m going to have to research that 😉

Yay! Let me know if you find a perfect card for churning. I’m always on the lookout for good ones.

Yeah! There’s no reason to travel uncomfortably. It’s pretty easy to travel well once you figure out the system.

Yeah! It’s all about spending smart so you can live and travel well.

There’s a lot out there to help us all travel better 😉

Best part is flying comfortably. A good flight can make such a difference when it comes to enjoying the rest of your trip.

Yeah! It’s not just about the free travel, but about the quality of travel. I would not have been able to see the world without credit card miles.

Sounds like it’s the perfect time to start…that way when you do take that very special trip, you can make it amazing.

How are those airlines. I usually do trains in Europe (they’re so darn comfy), but I’ve been thinking of trying out those more inexpensive airlines.